Co-Living and Shared Living Investment Properties

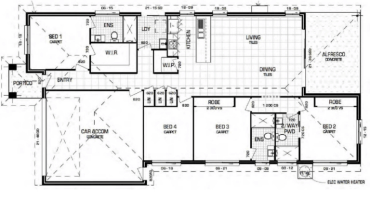

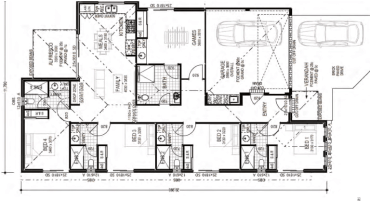

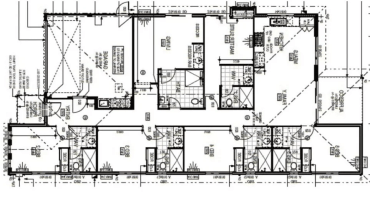

Introducing our enhanced shared living and co-living investment properties, tailored to meet Australia’s evolving housing demands. These purpose-built models feature increased space and optimised layouts, addressing a growing need in the market.

Pioneering a world-first design, investors can now tap into designer co-living housing. These properties offer the potential for exceptional rental yields and capital growth, while also helping to improve rental affordability and reduce social isolation across Australia.

Positive Income Properties can help investors achieve this by providing a complete service package, including:

- Sourcing custom-built communal living properties

- Assisting with finance

- Providing a concierge service to tenants

- Offering a rental guarantee

Contact Positive Income Properties today to find out more.