Property owners can receive several benefits by investing in NDIS (National Disability Insurance Scheme) rentals, particularly Specialist Disability Accommodation (SDA) over and above traditional rental properties. Here are some major justifications for why NDIS rentals are viewed favourably as investments:

Government Assistance: The NDIS is a government-funded programme that offers financial assistance to qualified people with disabilities. As a result, the NDIS normally pays the rent for NDIS rentals, providing security and stability for investors.

How can the government pay so much rental for SDA bedrooms?

The answer to that question as well as the benefits of investing in a NDIS SDA is demonstrated by the savings the government makes by outsourcing the supply of SDA rooms to private investors show why it is a stable long term property investment.

Government Cost Savings

At Positive Income Properties, we are asked how can the government pay such high rentals?

An SDA participant in a hospital bed costs the government $1000 to $2000 PER DAY depending on their disability.

Hospital Costs

If the government was required to house and care for over 35,000 SDA participants, it would eventually cost over $15 BILLION per year.

Cost of Annual SDA Rentals

The annual budget for SDA Rentals is $800 Million

The average daily government and participant rental for an NDIS SDA room is currently approximately $120 per day.

Main figures

All SDAs in hospital care $15 Billion

All SDA rental cost $800 Million

Current cost for SDA room rental $255 Million

As you can see by outsourcing the supply of accommodation the government has made a great financial decision as well as outsourcing the supply and maintenance of the NDIS SDAs to organisations that have the participants’ interest as their main tenant.

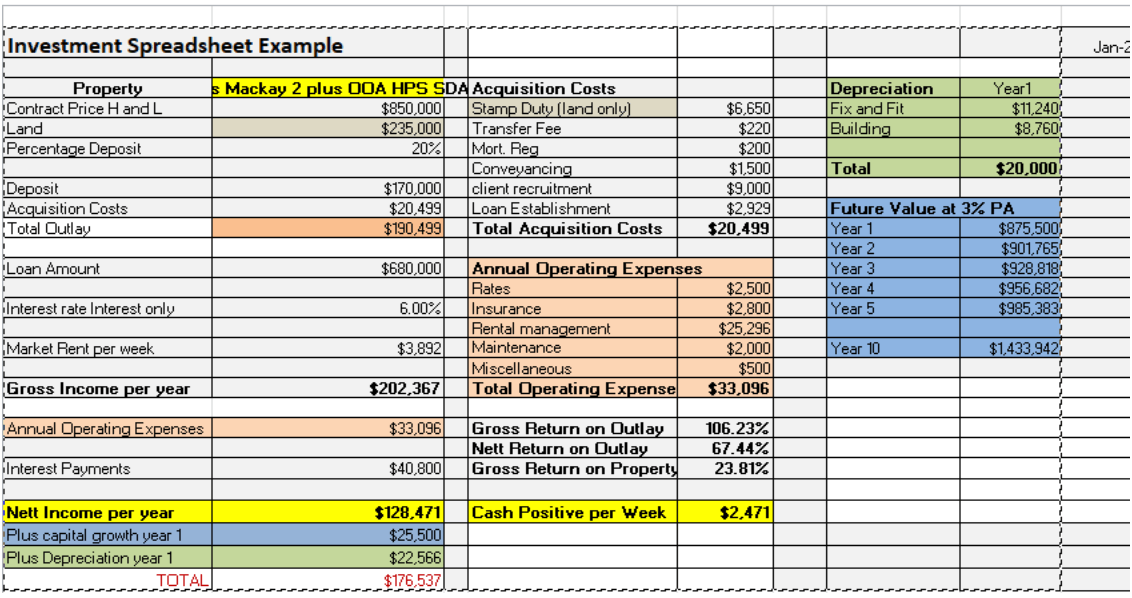

Rental Yield: As Above when compared to conventional residential homes, NDIS rentals typically produce higher rental yields. This is primarily because SDA homes are specialised and meet the specific needs of people with disabilities.

Demand: Because there are less acceptable lodgings than required for people with impairments, there is a high demand for new NDIS rentals. This lowers the likelihood of vacancies by establishing a solid and dependable tenant base.

Long-Term Lease Agreements: Long-term lease agreements with Specialist Disability Accommodation providers are customary for NDIS rentals. These contracts offer investors a reliable source of rental income, frequently with the possibility of longer lease terms and annual rental indexation.

Potential for Capital Growth: While the capital growth of NDIS rentals may be different from that of regular properties, over time, favourable capital growth may be possible due to the rising need for adequate lodging and the dearth of alternatives.

In addition, NDIS SDA properties may also be sold on a commercial basis utilising market cap rate, which depending on the income at the time of sale, could lead to a strong capital appreciation.

Positive Social Impact: By giving people with disabilities the much-needed housing options they require, investments in NDIS rentals enable investors to have a positive social impact. Investors may benefit personally from this and it is consistent with socially responsible investing.

Government Incentives: The government occasionally provides grants or incentives to promote investment in NDIS rentals. These rewards may offer extra financial advantages and raise the overall return on investment.

Potential for Portfolio Diversification: Purchasing NDIS rentals might assist real estate investors who already own a portfolio of conventional homes or businesses diversify their holdings, reducing risk and balancing their entire investment strategy.

Future Growth Prospects: The NDIS framework is still being improved upon, and new disability support services are being added all the time. This highlights future expansion opportunities for NDIS rentals.

The high demand, long-term lease agreements, government support, appealing rental yields, potential for capital growth, positive social impact, government incentives, specialised property management, diversification opportunities, and future growth prospects of NDIS rentals make them a good investment. Before making judgements on investing in NDIS rentals, it is crucial to do extensive research, get professional guidance, and evaluate specific circumstances.